Insights

When Focusing on Sustainable Business Models, Consumer Stocks Have Potential

Featured

When Focusing on Sustainable Business Models, Consumer Stocks Have Potential

Latest

All Articles ()

There are currently no articles for this filter

KEY POINTS

1. Consumers overall remain resilient, but pockets of weakness are apparent.

2. Inflation is easing but not yet deflationary, as labor costs remain a headwind.

3. Renewed focus on innovation and investment behind brands is welcome.

4. Greater resilience is seen from companies with sustainable business models.

London - The general mood among consumer companies' management teams remains optimistic and confident, even as investors appear to be more fearful of the outlook for consumer spending and the inevitable return to promotional intensity to maintain top-line growth. As we approach the final quarter of the year, it's timely to check in with consumers and see where there's potential for increased allocation.

Like many other industries, consumer companies have faced unprecedented challenges over the past three years. We have observed companies benefiting from a shift to big brands and stay-at-home consumption during the COVID-19 pandemic, while some retailers faced horrendous supply chain problems leading to the worst service and cost pressures in 30 years.

In our view, it's positive that many have embarked on SKU (stock keeping unit) rationalization — the process of examining existing products and eliminating any SKUs that are underperforming or unneeded within your catalog. Successfully achieving extraordinary price increases over the past two years has understandably impacted the volumes sold. Price elasticities, however, have remained better than historically witnessed.

Investors are now wondering if the consumer will continue to be resilient. As always, the answer is nuanced and varies by geography and demographics. Certainly, with pricing in developed markets akin to emerging markets in the past two years, we are starting to see some pressure points.

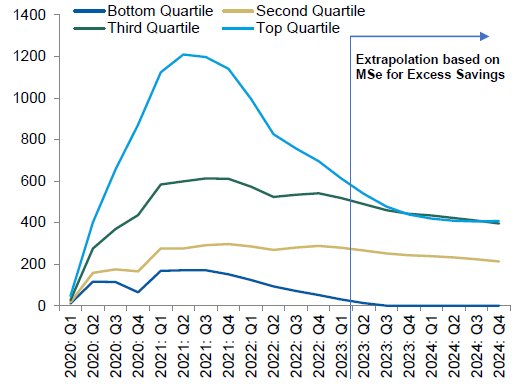

In the U.S., where the consumer has been more resilient than expected, those on the low end are suffering. Their savings have been depleted and federal Supplemental Nutrition Assistance Program (SNAP) benefits have been reduced, which impacts food retailers and packaged brands as consumers seek cheaper, smaller products and swap name brands for private labels.

We have also seen signs that Middle America is starting to feel the pinch with evidence of trade down among middle-income consumers. They are prioritizing spending, resulting in an increased frequency of purchases and a decrease in the amount they are buying.

One mitigating positive for low-end consumers is that employment levels remain high, and there is talk of wage growth catching up with inflation for that segment. Indeed, continued wage inflation was a consistent call out across management teams that we met recently.

Excess savings by income quartile ($billions)

Source: Federal Reserve, Bureau of Economic Analysis, Morgan Stanley Research, August 7, 2023.

Conditions vary across the world in the wake of the pandemic recovery

Looking around the world, Europe has remained resilient, but signs are emerging of weaker consumer volumes and trading down to private labels. The competitive dynamic between European retailers has increased, and all companies have achieved the price gains they required. One European company noted recently how the double-digit price increase it achieved at the start of this year is more than the cumulative price increase in the past decade.

Latin America has been mixed. The Brazilian consumer has been incredibly resilient and is now showing signs of trading down. It's a similar story in Mexico, while Argentina is clearly under more pressure. Within Africa, Nigeria and Egypt were more constant call outs for consumer weakness, although some view the structural reforms in Nigeria as positive for the long term.

Consumer strength remains strong in India, where we expect a clear long-term structural growth story for many companies. Meanwhile, weakness persists in China, which is still struggling to rebound from COVID-19, as exports and real estate lag, while youth unemployment lingers. There has been no sense that improvement in consumer spending is coming anytime soon.

Sustainable business models fuel optimism

Despite headwinds for many consumer companies, bright spots remain. Confidence at the company level overall is notable, especially among those with sustainable business models. Companies with characteristics such as secular sales growth, improving profitability and higher returns on capital invested are thriving over the long run as they tend to be more agile — able to shift and manage their business regardless of the broader macro environment.

We are optimistic that such companies can hold onto much of the pricing that has been achieved. While promotions will inevitably increase, they are still expected to be rational with greater focus on the promotional returns. At least for now, that can assuage fears of a race to the bottom. As one company put it, "we haven't taken 25% pricing in the past two years to throw it all away."

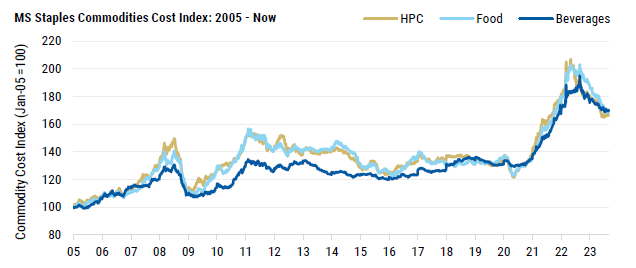

While inflation is receding, we are not yet in a deflationary world. It certainly feels like we have passed peak costs, with companies noting a better balance between volume, mix and price going forward. Overall commodities remain mixed: Many are down year on year, but they are still up more than 25% on 2020 levels. Therefore, we believe there is potential that all the pricing won't be given back.

Morgan Stanley Commodities Cost Index: Long-term history

Source: Datastream, Morgan Stanley Research.

It is clear the cost of doing business is increasing. Shrink, for example, has become an increasing cost pressure in the past year. This is partly cyclical and partly down to changes in prosecution rules. If this doesn't improve, unfortunately it will be reflected in increased product costs for the consumer over time.

More companies embrace ESG, boost advertising spending

Strong environmental, social and governance (ESG) characteristics are critical to the sustainability of a company's business model, and we incorporate ESG insights into our assessment of that sustainability. We see more companies embracing ESG factors as a key part of their business model, and there is more urgency to focus on supply chain, plastics and human capital management, which has been bolstered by increasing EU regulation. The associated costs will likely have to be offset by productivity savings and mix, as consumers are unlikely to pay more.

We are pleased to hear the mantra of increased investment in advertising. Over the past two years, many companies have pulled back on advertising spend, partly because they didn't have the product on shelf and in some cases partly to protect margins. We are strong believers that the only way to build powerful brands for the long term is advertising investment and innovation. Many companies have started to admit that innovation took a back seat in recent years, but now the focus must shift to innovation, as this is the only way to drive volume and mix growth.

Bottom line: Despite pockets of weakness globally, overall the consumer remains resilient. We continue to look for consumer companies with sustainable business models. While the macro environment is still uncertain, these companies are well invested and exposed to categories with secular sales growth. The pricing achieved in developed markets in the past two years has been phenomenal. If much of this is retained while investing in innovation, marketing and capex, we see top-line growth with margin recapture returning, driving higher cash flows and higher returns on invested capital — key ingredients for the compounding ability of these companies.