Insights

Increased Demand for Life Science Tools Fuels Potential Investment Opportunity

Featured

Increased Demand for Life Science Tools Fuels Potential Investment Opportunity

Latest

All Articles ()

There are currently no articles for this filter

KEY POINTS

1. We believe life science tools offer an attractive investment emerging from the COVID bubble.

2. In our view, there are many reasons that the sub-sector may experience positive long-term growth.

3. Bottom-up selectivity may identify leading companies unappreciated within the sub-sector.

Boston - Macroeconomic concerns and apprehension over destocking have created a dislocation of the life science tools sub-sector within healthcare. We view these concerns as short term and short sighted, as our team process is to think beyond near-term noise and focus on fundamentals and longer-term opportunities. Based on our analysis, we believe there will be long-term durability of life science spending.

Scarcity heading into the pandemic led to a general hoarding of supplies needed to make medicines. The COVID-19 period was generally an elevated bubble in terms of securing funding for new medicines and clinical trials which caused direct impact on increased demand for life science tools.

Now we are seeing a temporary pause for life science tools, largely due to destocking, although investment in new life science tools has returned to more normal levels.

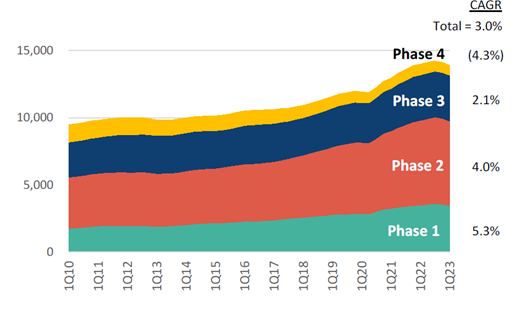

At the same time, however, drug development levels and associated active medical trials remain elevated compared to the 2010-2020 period. Even coming off the recent pandemic euphoria for this industry, long-term secular growth remains strong. We observe a secular trend of higher trial growth in earlier phases of drug development, which corresponds with 50% of recent venture capital deals involving early-stage deals. These deals coming to fruition should ultimately result in more new product creation and a very healthy drug pipeline.

Active medical trials continue to flourish

Source: Clinicaltrials.gov, Jefferies as of March 31, 2023.

Drug development will ultimately require more from life science companies, the picks and shovels of the health care industry. For instance, sales of GLP-1 (diabetes and weight loss drugs) are projected to grow at a 15% to 23% compound annual growth rate (CAGR) over the next three years. Market leaders, including Novo Nordisk's Wegovy and Eli Lilly's Mounjaro, are expected to steer growth. We believe life science companies will benefit from the growth by selling everything from input material to sterile fill/finish services. Moreover, there is a movement toward more biologic drugs in the market. These necessitate more complex manufacturing provided by life science companies.

Our team's analysis of the biopharma industry's upstream innovations, such as cell therapy, gene editing and targeted therapeutics, shows potential for the long-term durability of life science spending. Furthermore, select companies in this sub-sector that may potentially benefit are aligned with our team's Opportunistic Value investment philosophy. These quality companies generally exhibit high returns on invested capital and have strong cash flow — key characteristics our analysts seek in the companies we invest in. They are also competitively well positioned with robust moats and solid management teams, which are important attributes of our team's investment philosophy.

Bottom line: While we believe now is an interesting time to consider life science tools companies, not all opportunities within the space are equal. We look at both product mix and customer mix to determine the winners and losers. Employing an active management approach and thoroughly evaluating companies is crucial.

Also contributing to this blog:

Jason Kritzer, CFA

Equity Analyst

Pharmaceuticals, Biotech

Moran Zhang, CFA

Equity Analyst

Life Sciences Tools & Diagnostics, Medical Devices, Healthcare Services, Packaging