Insights

High Yield Municipal Bonds: Now May Be a Good Time to Invest

Featured

High Yield Municipal Bonds: Now May Be a Good Time to Invest

Latest

All Articles ()

There are currently no articles for this filter

KEY POINTS

1. High yield municipal bonds are even more attractive, based on both absolute yields and spreads.

2. Based on snapbacks from past sell-offs and Fed tightening cycles, this HY muni rally may still have room to run.

3. Whether the economy moves to a soft landing or recession, we believe high quality HY munis can hold up well.

Boston - High yield municipal bond performance has been impressive so far in 2023. Despite this, we believe there are three reasons why now is still a good time to invest in HY muni bonds.

Attractive current spreads and yields

At 250 basis points (bps) relative to AAA municipal bonds, HY muni spreads remain attractive. They are now slightly wider than their five-year average, 92 bps wider than at the start of 2022 and 35 bps wider than one year ago. While spreads are attractive, they are not at the "wides" we have seen during times of stress, like the onset of the COVID pandemic in Spring 2020 or the Global Financial Crisis in 2008.

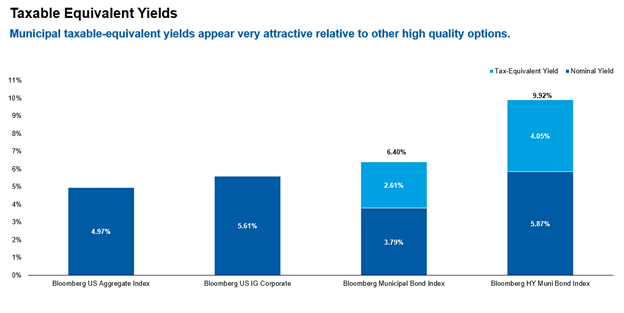

At 5.87%, the yield on the Bloomberg High Yield Municipal Bond Index1 is even more attractive. This yield is 273 bps higher than at the start of 2022 and up 53 bps from one year ago. Aside from a short period of time last year and during the COVID-driven turmoil in Spring 2020, the last time the HY index yielded this much was in early 2017.

Source: Barclays Live as of August 30, 2023, Tax Policy Center. This table is for illustrative purposes only and uses the highest current applicable federal tax rates plus 3.8% health care tax. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

Still room to run for HY muni rally

Since 2009, there have been five major sell-offs in the HY muni market. In the recovery from each low point, on average, the benchmark has generated approximately a 20% total return over the next 12 months. The HY muni index has returned 9.2% in the 10 months since its low in October 2022. Based on the historical experience, we believe there could be more room for HY munis to run.

Besides that, the U.S. Federal Reserve is broadly believed to be at or near the end of this rate tightening cycle. During the Fed's last three rate rising cycles in 2000, 2006 and 2018, the HY Muni Index generated an average return of 9.23% over the 12 months after the final rate hike. Therefore, if the Fed is done, we think it could be a good time to move some cash into HY munis.

Soft landing or recession, focus on high quality HY munis

Again, HY muni spreads are 66 bps wider than they were a year ago, in contrast to the HY corporate bond market, where spreads are 63 bps tighter than at this point last year. According to a recent report from Bank of America (BofA), "corporate credit spreads are [currently] trading as if the economy will avoid a recession. Muni spreads are lagging far behind." In the event of a soft landing, BofA estimates that for muni credit spreads to match corporates, the HY muni high yield index spread would have to narrow approximately 70 bps.

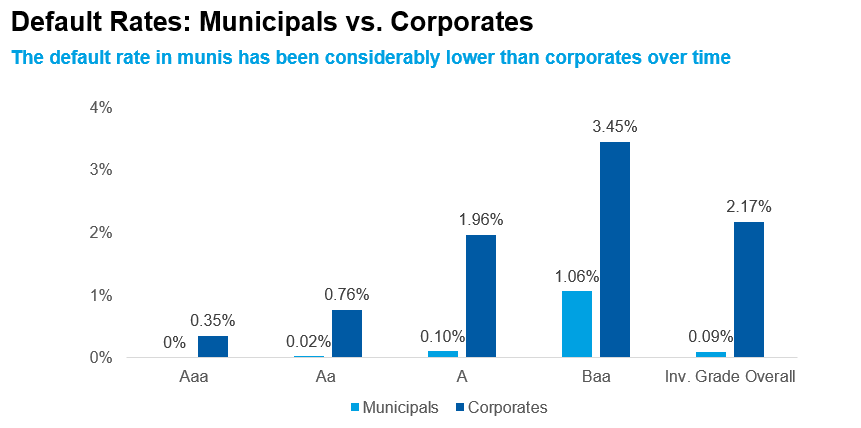

If there is no soft landing, we could enter a recession at some point later this year or next, which could lead to some credit weakening. However, according to Moody's, based on data from 1970 to 2021, default rates have been significantly lower for municipals than for corporates over time.

Source: Moody's Investors Service: US Municipal Bond Defaults and Recoveries, 1970-2021.

We believe that owning high quality assets is key in a recessionary environment. Investing in higher quality HY munis rated BBB or in the upper end of the below investment grade market is our preference. Being very selective in non-rated credits is also important, as they tend to be the most speculative credits in the market.

Bottom line: We have reviewed the reasons why we believe that it is an attractive time to invest in the HY muni market. Furthermore, through June 30, the HY muni index has outperformed the Bloomberg Municipal Bond Index2 over three, five, 10 and 15 years. Therefore, based on this evidence, investors may want to consider HY municipal bonds as a core allocation in their portfolios.

1 Bloomberg High Yield Municipal Bond Index is an unmanaged index of non-investment grade municipal bonds traded in the U.S.

2 Bloomberg Municipal Bond Index is an unmanaged index of municipal bonds traded in the U.S.