Insights

EM Debt Moves Higher on Spread Tightening, Monetary Policies

Featured

EM Debt Moves Higher on Spread Tightening, Monetary Policies

Latest

All Articles ()

There are currently no articles for this filter

Boston - Like most risk assets, emerging markets (EM) debt produced positive performance during the second quarter of the year. With the market outlook broadly expected to improve, we see compelling opportunities in EM debt that may offer particularly attractive compensation to investors.

Reviewing the second quarter

Disinflationary trends across many global economies, coupled with lower market volatility and containment of the U.S. banking failures, helped boost performance across all EMD segments. China's economic recovery was shorter and shallower than expected, but the contagion effects were limited in view of robust EM growth expectations.

EM central banks pursued a more orthodox monetary policy than their developed market (DM) peers, with a bias toward holding rates steady or easing. As a result, EM interest rates broadly rallied during the quarter, while DM rates broadly sold off. Local markets (FX and rates) saw the strongest gains, with the USD-denominated hard currency segments (sovereign and corporate) benefiting from spread tightening.

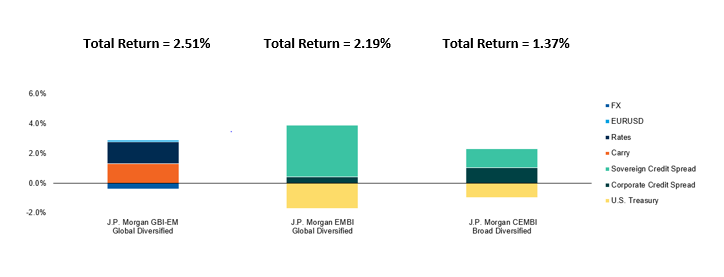

All three segments in the EM debt sector posted positive returns for the second quarter:

- EM local-currency debt registered the strongest gains, at 2.51%, given broadly flat currencies with falling local interest rates.

- Dollar-denominated, hard-currency debt gained 2.19% as spreads tightened noticeably, overcoming the sell-off in U.S. Treasury yields.

- Corporate EM debt, the other hard-currency EM debt segment, also benefited from spread tightening that offset the move higher in U.S. Treasury yields, returning 1.37%.

Currency Again Led EM Debt Performance in 2Q23 Sources: JP Morgan, Morgan Stanley Investment Management, June 30, 2023. Past performance is no guarantee of future results. Data provided for informational purposes only. It is not possible to invest directly in an index. The vertical axis reflects the amount contributed by each factor to total return - adding the bars above 0% and below 0% (negative numbers) results in the total return. FX is the gain or loss in the GBI-EM from currency changes relative to the U.S. dollar. EURUSD reflects the portion of currency movement in the GBI-EM that is explained by the change of the euro versus the U.S. dollar. Rates refers to the contribution of change in local-currency interest rates in the GBI-EM. Carry refers to the risk-free returns in each GBI-EM country that cannot be attributed to FX, EURUSD or rates. Sovereign credit spread refers to the spread above U.S. Treasurys in the EMBI paid by a country. Corporate credit spread is the spread above the sovereign spread paid by an EM corporate issuer. U.S. Treasury refers to the contribution to return in the EMBI and CEMBI (both dollar-denominated indexes) due to interest-rate changes on the U.S. Treasury.

Sources: JP Morgan, Morgan Stanley Investment Management, June 30, 2023. Past performance is no guarantee of future results. Data provided for informational purposes only. It is not possible to invest directly in an index. The vertical axis reflects the amount contributed by each factor to total return - adding the bars above 0% and below 0% (negative numbers) results in the total return. FX is the gain or loss in the GBI-EM from currency changes relative to the U.S. dollar. EURUSD reflects the portion of currency movement in the GBI-EM that is explained by the change of the euro versus the U.S. dollar. Rates refers to the contribution of change in local-currency interest rates in the GBI-EM. Carry refers to the risk-free returns in each GBI-EM country that cannot be attributed to FX, EURUSD or rates. Sovereign credit spread refers to the spread above U.S. Treasurys in the EMBI paid by a country. Corporate credit spread is the spread above the sovereign spread paid by an EM corporate issuer. U.S. Treasury refers to the contribution to return in the EMBI and CEMBI (both dollar-denominated indexes) due to interest-rate changes on the U.S. Treasury.

Other notable events from the recent quarter:

- Credit spreads almost universally tightened during the period. Progress on debt restructuring for Suriname, Zambia and Sri Lanka was positive news for the overall market.

- While the Wagner Group rebellion was diffused, a shift in Russian politics appears afoot and bears watching closely as potential implications are vast.

- South Africa's energy crisis may have peaked during the quarter further fueling inflation, currency weakness, and a rate hike by the SARB.

- Less robust than expected, China's economic recovery seemingly ran out of steam before the end of the quarter. Chinese property developers remain stuck in a liquidity and solvency crisis with limited prospects for recovery for bondholders.

Looking ahead

We continue to see a number of reasons to be upbeat on the outlook for EM debt. Valuations remain quite compelling across the EM universe relative to developed markets. Although mixed, fundamentals overall appear to be improving. Along with central bank decisions, we believe fiscal policy will be critical moving forward and is likely to vary significantly country to country.

The divergence between EM and DM interest rates seen during the second quarter may not persist; further declines in EM rates will likely need declines in DM rates. The terminal rate for Federal Reserve (Fed) policy remains uncertain as it balances inflation with softening pockets of the U.S. economy and EM markets will not be immune to Fed actions.

Commodity prices, which fell a bit further during the quarter, should ease pressures on importers. From a 10-year perspective, however, raw material prices remain elevated, which should support export receipts for commodity-producing countries.

Politics are crucial for EM investing and, as always, vary broadly across countries. Upcoming elections in Argentina and Ecuador are critical while Thailand's election of a Prime Minister — recently postponed by the new parliament — could ultimately reshape the political system there. Meanwhile, politics in China and many countries across the Middle East are relatively clear, but we see EM geopolitics as very consequential at this juncture.

Bottom line: We believe opportunities abound for EM debt investors today. However, growth, inflation and fiscal policy are quite divergent among EM countries. Accordingly, we expect markets to place an emphasis on differentiation among countries and credits. That creates opportunities for investors with the research acumen and investment reach to access attractive credits across this far-flung, diverse asset class.